All Categories

Featured

Table of Contents

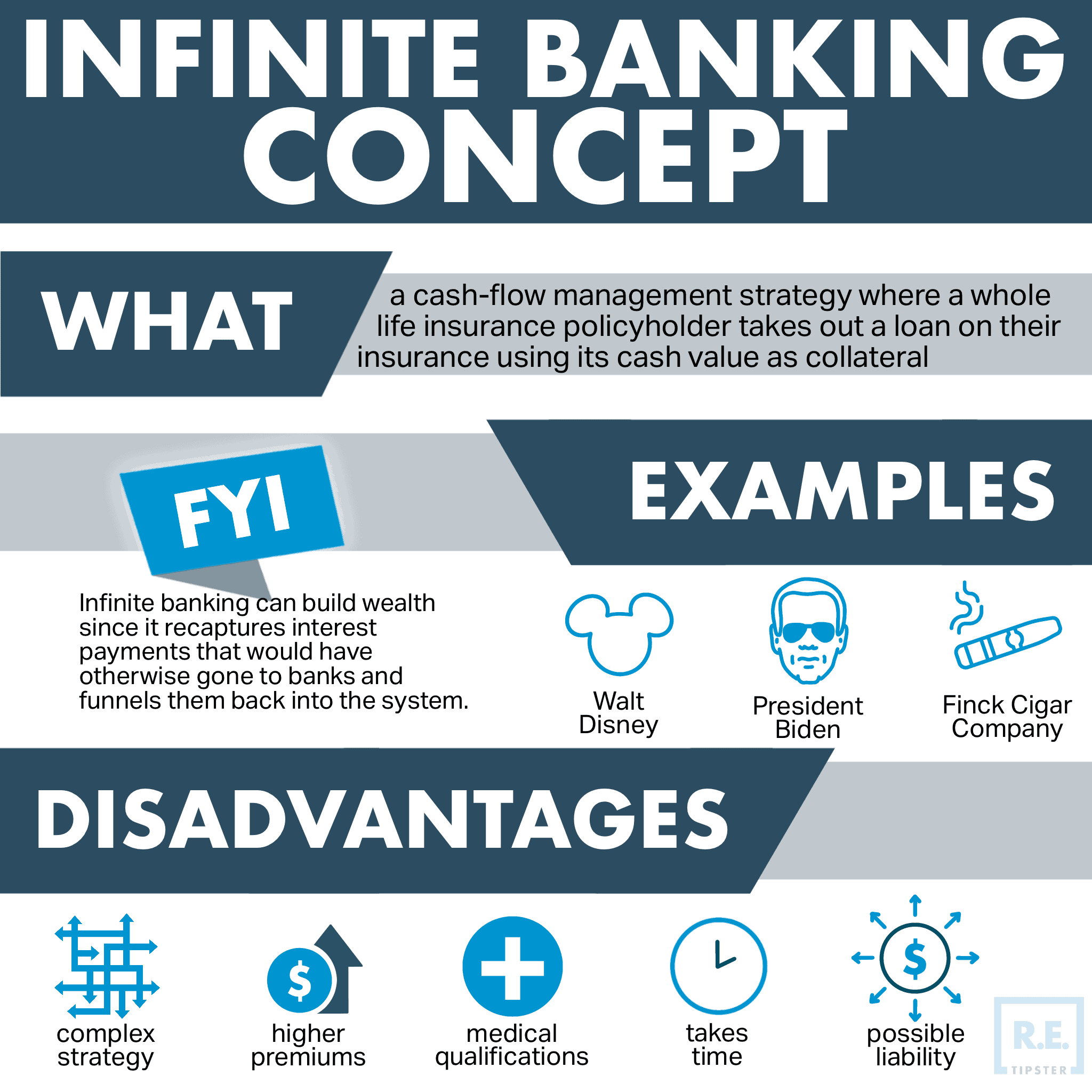

He introduced the "Infinite Financial Idea" (IBC) in the united state in 2000, and at some point it moved to Canada. An short article on limitless banking that appeared both on and in the Financial Post early in 2022 birthed a simplistic heading that stated, partially, "how to maintain your money and invest it too." The writerClayton Jarvis, then a MoneyWise home mortgage reporterframed the principle by proclaiming that the issue with the average Canadian's funding is that it's normally doing just one job at once: it's spent, lent or invested.

Obtain personalized quotes from Canada's top life insurance carriers.

Basically, this is a life insurance policy sale. If one embarks on an external or collateralized finance versus a plan funding, they may be compensated on the financing too.".

Nelson Nash Infinite Banking Book

Numerous individuals have never ever listened to of Infinite Financial. We're below to alter that. Infinite Banking is a method to handle your cash in which you develop an individual financial institution that functions simply like a normal financial institution.

Just put, you're doing the financial, yet rather of depending on the typical bank, you have your own system and total control.

Infinite Financial isn't called this way without a reasonwe have unlimited means of implementing this procedure into our lives in order to genuinely own our way of life. So, in today's post, we'll reveal you 4 various means to utilize Infinite Financial in company. We'll talk about six ways you can make use of Infinite Banking directly.

Bank Of China Visa Infinite Card

When it involves organization, you can utilize Infinite Banking or the money value from your entire life insurance plans for startup expenses. You understand that you require money to start an organization. Instead of loaning from somebody else, simply use your insurance plan. The money is right there, and you pay that cash back to yourself.

Why not treat on your own the exact very same method? The concept of Infinite Financial works only if you treat your personal financial institution the very same method you would certainly a routine bank. You can also make use of loans for one of the most crucial points, which is tax obligations. As a company proprietor, you pay a great deal of cash in tax obligations, whether quarterly or annually.

Infinity Life Insurance Company

That method, you have the cash to pay tax obligations the following year or the next quarter. If you want to discover more, take a look at our previous write-ups, where we cover what the tax obligation benefits of a whole life insurance policy policy are and exactly how you can pay tax obligations via your system.

You can conveniently offer money to your business for costs. After that, you can pay that money back to yourself with personal interest.

And we did that exactly. We used our dividend-paying life insurance policy to acquire a residential or commercial property in the Dominican Republic. That was our desire for as long, and it lastly took place when we did thisa mindset shift. It's insufficient to only discover cash; we require to recognize the psychology of cash.

Acquire a vehicle on your own, your youngsters, or your expanded family members. We purchased a cars and truck for regarding $42,000. You may be asking yourself just how. Well, we used our entire life the same means we would if we were to fund it from a financial institution. We had a mid- to low-level credit report score at the time, and the passion rate on that car would certainly be around 8%.

Ibc Life Insurance

Infinite Banking is copying the typical banking procedure, yet you're recording interest and growing cash rather of the banks. We end up charging them on a debt card and making month-to-month repayments back to that card with principal and passion.

One of the very best ways to utilize Infinite Banking is to pay down your debt. Pay on your own back that principal and rate of interest that you're paying back to the financial institution, which is big. When we initially began our financial system, it was due to the fact that we intended to erase our financial obligation. Infinite Financial provides you control over your banking functions, and afterwards you really start to look at the money differently.

Just how numerous people are strained with pupil finances? You can pay off your pupil financial debt and guarantee your youngsters' university tuition thanks to your entire life plan's cash value.

Again, the great feature of Infinite Financial - how do i start infinite banking is that the insurance provider doesn't ask you, "What is this cash for?" That permits you to utilize it for whatever you want. You can use your car loans for a variety of different points, however in order for Infinite Banking to function, you require to be sure that you comply with the 3 guidelines: Pay yourself first; Pay yourself rate of interest; Regain all the cash so it comes back to you.

That's because this thing can expand and optimize nevertheless you invest cash. Everyone's lifestyle is totally different from the following individual's, so what might be hassle-free for us might not be convenient for you. But most significantly, you can make use of Infinite Financial to finance your own way of living. You can be your own lender with a way of living financial method.

With an entire life insurance plan, we have no threat, and at any moment we understand what is happening with our cash since only we have control over it. From which life insurance coverage business should I obtain my entire life plan?

Visa Infinite Alliance Bank

When you place your cash into financial institutions, for you, that cash is only sitting there. It means the amount you place in expands at a particular rate of interest rate, however only if you don't utilize it. If you need your cash for something, you can access it (under some problems), but you will interrupt its development.

In other words, your money is assisting banks make more money. You can't build riches with routine financial institutions since they are doing it instead of you. However,.

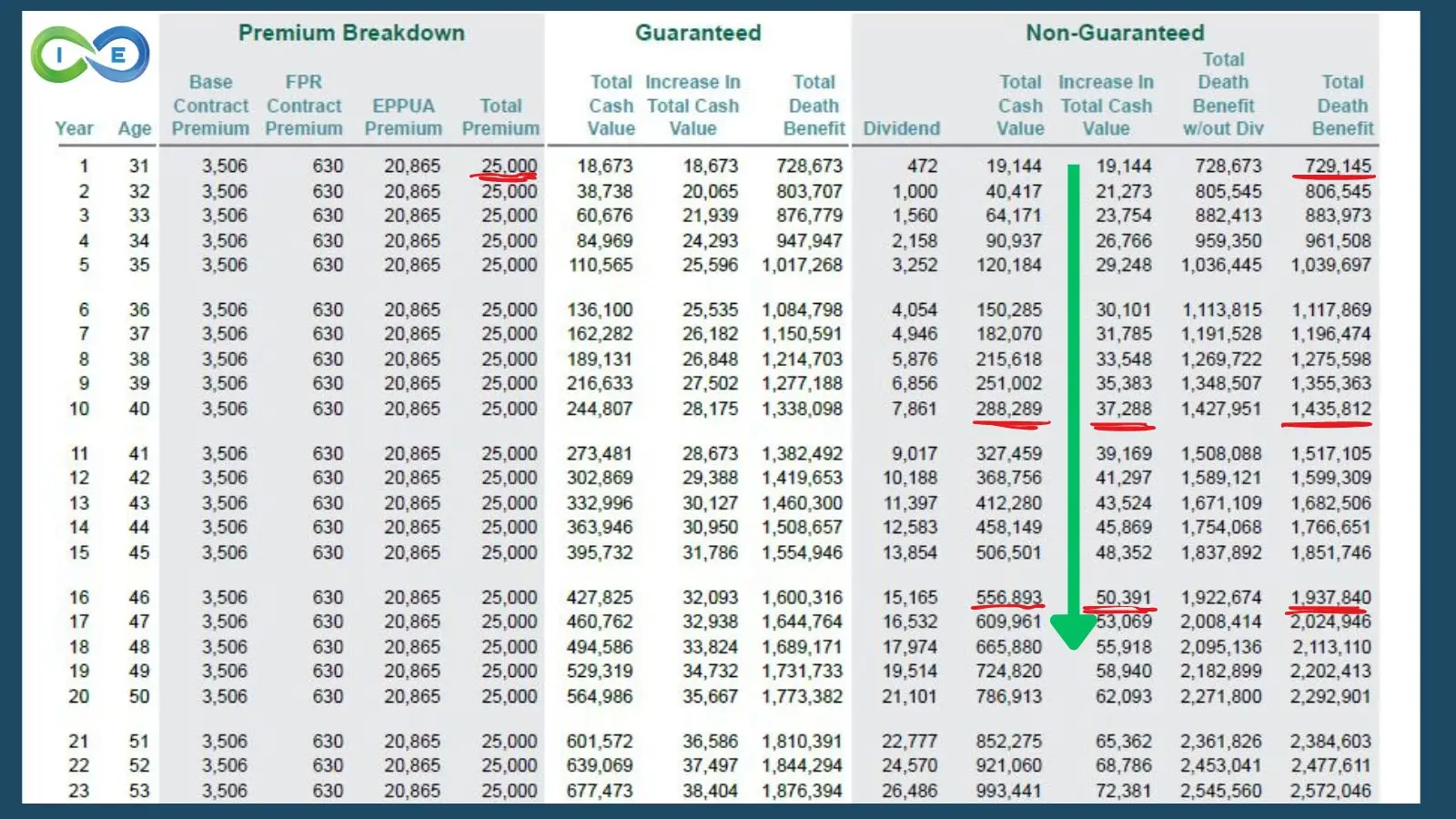

For lots of people, the biggest issue with the boundless financial concept is that first hit to early liquidity created by the costs. Although this disadvantage of limitless banking can be minimized significantly with proper plan design, the initial years will always be the most awful years with any kind of Whole Life plan.

R Nelson Nash Infinite Banking Concept

That claimed, there are certain infinite banking life insurance policy policies designed mainly for high very early money value (HECV) of over 90% in the very first year. However, the long-lasting performance will certainly usually considerably delay the best-performing Infinite Financial life insurance coverage plans. Having access to that added 4 numbers in the first few years may come at the cost of 6-figures in the future.

You really get some considerable long-term advantages that help you recover these early expenses and after that some. We locate that this impeded very early liquidity trouble with limitless banking is extra mental than anything else once extensively discovered. If they definitely needed every penny of the cash missing from their infinite banking life insurance policy in the very first few years.

Table of Contents

Latest Posts

Bank On Yourself Problems

Nash Infinite Banking

Infinite Banking Concept Wikipedia

More

Latest Posts

Bank On Yourself Problems

Nash Infinite Banking

Infinite Banking Concept Wikipedia